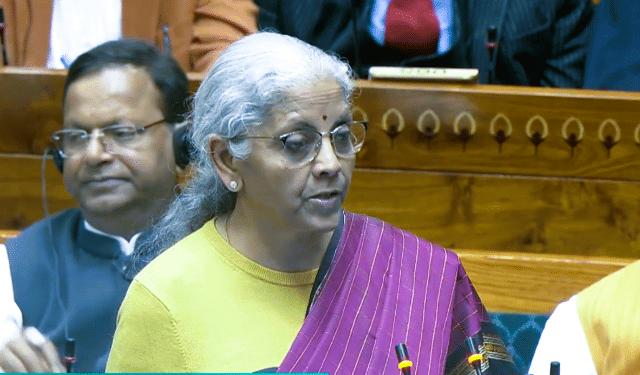

New Income Tax Act to Take Effect from April 1, 2026: FM Sitharaman Announces in Union Budget 2026–27

Finance Minister Nirmala Sitharaman has announced that a new Income Tax Act will come into force on April 1, 2026, marking a historic overhaul of India’s tax regime.

Presenting the Union Budget 2026–27, she emphasised that the new law aims to simplify compliance, enhance transparency, and make the system more taxpayer-friendly.

The reforms are designed to reduce litigation and introduce a rule-based automated process for small taxpayers, ensuring ease of compliance.

Sitharaman outlined three guiding principles—accelerating economic growth, strengthening skills and capacities, and ensuring equitable access to resources—as the foundation of the government’s fiscal strategy.

This announcement follows the sweeping changes introduced in Budget 2025, which made annual income up to Rs 12 lakh tax-free and revised tax slabs to benefit salaried individuals.

The new Act will replace the Income Tax Act of 1961, modernising India’s taxation framework to align with contemporary needs.

Experts believe the move will not only simplify tax administration but also boost investor confidence and strengthen India’s position as a resilient economy amid global volatility.